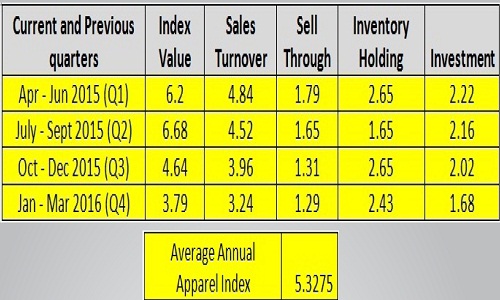

The apparel industry clocked in moderate growth in the four quarters of fiscal year 2015-16 (April ’15- March ’16). The index value of 5.32 points during this period was much lower than the Apparel Index for FY 14-15 at 7.28. In fact, FY15-16 ‘not so buoyant’ period with even the festive season, perceived as a season that helps in making up for turnover losses, as consumer sentiment is at its best at that time, not really recording very high growth.

The index value for last quarter of financial year 2015-16, registered the lowest growth at 3.79, among the four quarters and it grew the most during July-Sept 2015 quarter at 6.68 indicating business maximizing during this quarter which is dominated by EOSS and pre-festive quarter. This was closely followed by April-Jun '15 indicating a quarter known for summer season that generally sees rise in fresh sales.

Indicators dip in successive quarters

All indicators, viz. Sales Turnover, Sell Through and Investments reflected a consistent fall in growth value in successive quarter right from the first quarter. Except Inventory Holding that showed a significant improvement during July-Sept 2015, perhaps due to the offloading all inventories during EOSS quarter, that is why this quarter was the best performing quarter of FY 2015-16.

A comparison with last two financial years show the Apparel Index growth was much higher in FY14-15 compared to FY15-16, which was around 36 per cent higher at 7.28 against 5.33 in FY 2015-16. Interestingly, a common pattern was that the index fell in first three quarters from April-June, July-Sept, Sept-Dec in both years, except the fourth quarter, Jan-Mar of FY 2014-15, the index rebound strongly, whereas in the fourth quarter, Jan-Mar of FY 2015-16 , the growth further reduced. And this pattern was seen in all performance attributes: Sales Turnover, Sell Through, Investment, Inventory Holding in both financial years.

An analysis of Apparel Index, clearly indicates it is important to manage the two more important interdependent parameters Sales Turnover and Inventory Holding. The latter bogs down the index, hence clearing inventories even at discounts gives a boost to Sales Turnover. However, this does affect Sell Through to an extent. Independently increased Investment also adds to Sales Turnover, unless the investment is entrapped in inventory holding, that further pulls down the growth.

CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policy makers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building. The Apparel Index research is conducted by DFU Publications.