With the daily output of masks touches over 20 million, China introduces new standards for KN95, effective from July 1, as a part of the comprehensive efforts to ensure an quality and safe supply chain as the mask goes global.

COVID-19 drove up market demand for special gear like protective wear, face masks and sanitary textiles for hospital purposes, stimulating business for the technical textile industry. The export of non-wovens from January to April amounted to $17.257 billion, up by 79.62 percent, whereas face masks up by 986.36 percent and hospital wear (protective garment) up by 565.6 percent.

China Nonwovens & Industrial Textiles Association (CNITA) reported in the non-woven sector, the first four months of the year not only saw a 254.62 percent of wow growth in profits, while production rose only by 2.34 percent, and sales income up slightly by 3.66 percent, profit rate reaching 13.22 percent, a lot better than that of the whole textile industry that had been hovering around 4-5 percent in good old days.

New standards for masks to protect quality

Starting from July 1, the new standard for KN95 face masks, known as GB 2626-2019, will come into force on compulsory basis with more stringent requirements of respiratory resistance, air tightness, practicality, cleaning and sanitization etc., more favorably reflecting the mask performance in use. The new standard will take effect in lieu of the old GB 2626-2006, leaving the grace period for the masks produced prior to July 1 to keep the label on the package indicating the outgoing GB 2626-2006.

Starting from July 1, the new standard for KN95 face masks, known as GB 2626-2019, will come into force on compulsory basis with more stringent requirements of respiratory resistance, air tightness, practicality, cleaning and sanitization etc., more favorably reflecting the mask performance in use. The new standard will take effect in lieu of the old GB 2626-2006, leaving the grace period for the masks produced prior to July 1 to keep the label on the package indicating the outgoing GB 2626-2006.

The COVID-19 outbreak goaded a galloping investment in the mask production and the melt-blown nonwovens, raising worries not only about the overcapacity problems when the virus ebbs away, but also about the quality concerns while too many masks are produced on short notice and delivered to the market on pressing time. A more rigorous demand out of the industrial standards comes nothing short of a remedy to ensure a quality supply in competitive business environment.

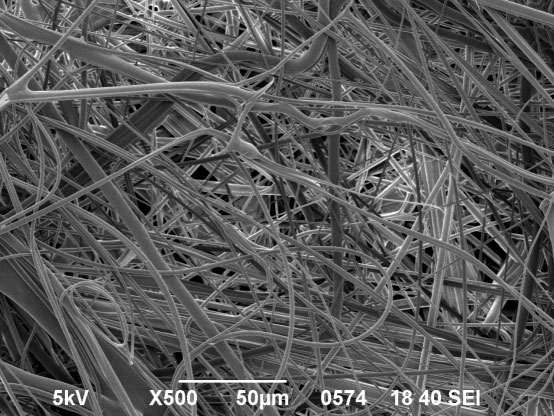

According to the Ministry of Industry and Information Technology (MIIT), the machinery utilization rate, or simply put, the operational rate of mask manufacturing industry outran 110 percent during the peak time of virus spreading in the country, reaching more than 20 million pieces of face masks produced a day, thanks to the complete value chain of nonwovens industry that had been expanding production capacity over the years with the product portfolios for everything for the masks, saying, core filter melt-blown nonwoven and upper and lower covers of spun-bonded nonwovens.

Unprecedented growth in Non-Wovens

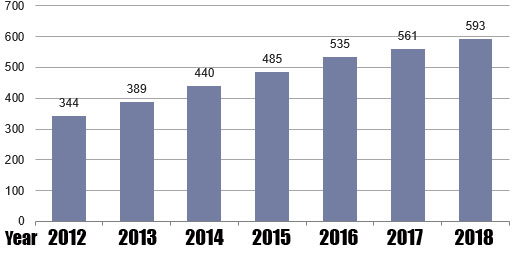

The official data shows that the market consumption of nonwovens came up to 107.1 billion Yuan in China in 2018 and stepped up to 114 billion Yuan last year that witnessed the nonwoven production for 5.03 million tons in 2019 to ensure the top seat both in consumption and production in the world. China Nonwovens & Industrial Textiles Association (CNITA) reported that the output added value of the technical textiles increased by 6.9%, higher than the averaged growth rate in the manufacturing industry of the national economy to take the lead in any other sector of the whole textile industry in China. Moreover, its nonwoven export was registered for 1.051 million tons in volume, up by 9.1 percent year-on-year.

The technical textiles stand out prominent in a sharp contrast to the other sectors of the whole textile industry, thanks to its particular areas of applications with its unique performance required of the products in non-apparel market consumption. And COVID-19 that emerged and spread rampantly in the first few months of this year drove up market demand for special gear like protective wear, face masks and sanitary textiles for hospital purposes, stimulating the technical textile industry to run at an amazing speed rarely seen before. The first four months of the year not only sees at a wow 254.62 percent growth of profit in non-woven sector, and it is all the more interesting to see that its production rose only by 2.34 percent, and sales income up slightly by 3.66 percent as against its gorgeous profit growth, making its profit rate reach 13.22 percent, a lot better than that of the whole textile industry that had been hovering around 4-5 percent in good old days.

The non-wovens are sought-after as much as in China as in the world market during this special period to combat the pandemic. The export of non-wovens from January to April amounted to $17.257 billion, up by 79.62 percent. If we itemize the product categories of the export, we see the export growth of face masks up by 986.36 percent, hospital wear (protective garment) up by 565.6 percent.

As the coronavirus is dying hard and threatening to come thick here and there with many lockdowns lifted and economy reopened globally, the demand for face masks is going to run viral, making it all the more important to invest in adequate production to catch the trend. And a more technically termed product, melt-blown fabric, continues to stand in the limelight.

Melt-blown Fabric vs Total Non-woven Production

| Non-woven Production Historical Trend (2012-2018) Unit: 10k ton |

|

As one of the non-woven series, melt-blown non-woven fabric is small in the production of the non-woven family, representing only less than 1 percent of the total if we look at 5.93222 million tons of non-woven turnout in 2018 when the actual volume of 53,523 tons of melt-blown fabric was given in spite of its 83,240 tons of the installed capacity.

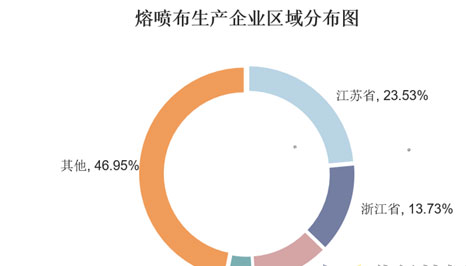

The melt-blown fabric is regarded as the heart of surgical masks and N95 healthcare masks and the producers of the non-wovens in general are found here and there across the country, but the melt-blown non-woven producers are not as many, they are largely concentrated in these important three provinces as in Jiangsu, accounting for 23.53 percent, in Zhejiang for 13.73 percent, in Henan for 11.76 percent, these three areas represent about half of the production in the particular sector of melt-blown fabric, and Hubei province is home to 2465 non-woven companies, the largest non-woven production in the country, but its melt-blown fabric is not as impressive, taking up merely 4.03 percent.

| Graphic I –Share of locations in total production of Melt-blown Nonwovens |

|

| (Provinces- Jiangsu 23.53%, Zhejiang 13.73%, Henan 11.76%. Hubei 4.03%, the rest by 46.95%) |

In fact, the non-woven production has been growing steadily over the years as the rapid economic growth expedited more consumption of technical textiles overboard and the nonwoven products are applied to many end-uses in growing volume across the sectors. The production of non-wovens is given below in the bar-graphics to illustrate the ramp-up in the years between 2012-2018.

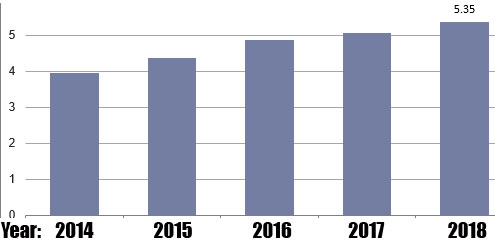

Apart from the growing trend of total non-woven production, the melt-blown sector, though a little member of the big family, prospects a quick curve-up as its unique property in filtering, obstructing, isolating and absorbing performance will give an impetus to more application to the mask production which is running in full capacity now, with more new lines to be installed on investment spur.

| Non-woven Production Historical Trend (2012-2018) Unit: 10k ton |

|

In 2018, China produced 4.54 billion pieces of face masks, up by 17 percent over 2017 figure for 3.66 billion pieces. If you just think about one layer of melt-blown fabric for an ordinary medical mask and three layers for a high grade N95 mask as it is an essential filtering core for masks, what a sizable production of this particular product is going to be in store in the future with the pandemic not being mitigated by the pre-maturing reopened economic activities that are taking place in some continents in the world?

Contributed by Mr. ZHAO Hong

He is working for CHINA TEXTILE magazine as Editor-in-Chief in addition to being involved in a plethora of activities for the textile industry. He has worked for the Engineering Institute of Ministry of Textile Industry, and for China National Textile Council and continues to serve the industry in the capacity of Deputy Director of China Textile International Exchange Centre, V. President of China Knitting Industry Association, V. President of China Textile Magazine and its Editor-in-Chief for the English Version, Deputy Director of News Centre of China National Textile and Apparel Council (CNTAC), Deputy Director of International Trade Office, CNTAC, Deputy Director of China Textile Economic Research Centre. He was also elected once ACT Chair of Private Sector Consulting Committee of International Textile and Clothing Bureau (ITCB)