The Bangladesh RMG segment is under a lot of pressure to retain its second position in apparel shipments to the European Union – ranked right after China as the undisputed leader-- even as their current profit margins sink deeper with international clothing brands demanding further discounts to place even small orders and most buyers inquiring but not placing any bulk quantities from their local apparel retailers.

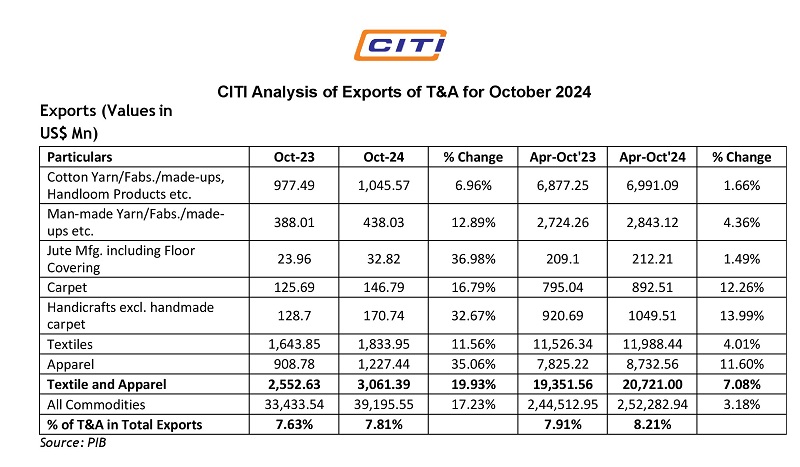

As per European Union’s to official stats, apparel imports from the world has declined 7.44 per cent during the first seven months of 2023 compared to the same period last year, signifying the EU’s import from the world declined to $52.38 billion in January-July 2023 from $56.60 billion in January-July 2022.

Both in quality and quantity, the EU’s clothing import from the world had a rapid slowdown by a massive 12.80 per cent which was down to 2.17 billion kg in Jan-Jul 2023 from 2.49 billion kg in January-July 2022. Although almost all the top 10 apparel-supplying countries to the EU have shown negative growth in both value and quantity, Bangladesh is affected the most as its economy depends a lot on RMG exports.

Bangladesh face run-up to dismal Christmas sales

Having already tackled unsold inventory and faced order cancelations from global brands due to logistics and transportation during Covid years and geo-political tensions due to Russia-Ukraine war, it may well be after the next spring season for the garment shipments to make profits. Consumers in the Western world are facing inflation and unsold old stocks are being brought out again in stores. Thus local garment exporters are not expecting any increase in shipments around Christmas sales. Earlier, nearly 60 per cent of Bangladesh apparel shipments were for the Christmas season - which started in September and continued up to the first week of December- but this year there are fewer work orders at even lower prices to buyers.

Suppliers from across the world face losses

The EU’s imports from Turkey which is the third largest apparel source also declined during the January-July period this year by 10.60 per cent in value term to $6.39 billion in January-July 2023 from $7.15 billion in January-July 2022. Even quantity-wise, there was a sharp decline of 22.52 per cent to 212 million kg of apparel from 273.63 million kg last year. At the same time, imports from India and Vietnam also fell by 5.79 per cent and 1.84 per cent respectively and in terms of quantity, both countries saw a drop decline of 11.49 per cent and 8.99 per cent respectively.

The scenario is the same for other top sourcing countries such as Cambodia, Pakistan, Morocco, Sri Lanka, and Indonesia in the January-July period with a respective decline of 7.20 per cent, 9.81 per cent, 12.59 per cent, 13.72 per cent and 17.56 per cent in value terms. At the same time, the EU’s global import price increased by 6.14 per cent in January-July 2023 while from Bangladesh it increased by 3.24 per cent, even though it cannot compete against the price-competitiveness of Chinese apparel.

However, the fact that Bangladesh has been performing relatively better than other global competitors during this period is not that it has suddenly become the most-preferred destination but more to do with the inflated raw material prices and subsequent hikes in production cost as the value of goods exported rose although overall volume has fallen.

With experts advising a cautious yet optimistic approach for the rest of the year as inflation and economic indicators started stabilizing in major export markets, it may just be a matter of time before things look up again for suppliers.