Brexit has prompted the UK to seek new trade partnerships globally, and a potential Free Trade Agreement (FTA) with India holds significant implications for the British apparel retail sector. While the primary focus of Brexit's impact has been on trade with the EU, this new dynamic with India could reshape sourcing, pricing, and sales for UK brands.

UK’s current market landscape

The UK apparel retail market is substantial. As per Statista in 2023, revenue was estimated at £64.5 billion, projected to reach nearly £79 billion by 2029. Pre-Brexit, a significant portion of the UK's apparel sourcing was from within the EU and other established manufacturing hubs. Brexit has disrupted these supply chains. However, increased import costs and logistical challenges post-Brexit have put upward pressure on apparel prices in the UK. While the market has grown overall, shifts in consumer behavior and inflationary pressures are influencing sales patterns.

Post-Brexit changes

Brexit has brought about significant changes in the UK apparel retail landscape, affecting trade, supply chains, and consumer behavior.

Trade barriers: The UK's departure from the EU has led to new trade barriers, including customs procedures, tariffs, and increased operational costs. These barriers have particularly impacted small and medium-sized enterprises (SMEs), which comprise a significant portion of the UK fashion industry.

Export challenges: UK exports to the EU, historically the largest export market, have fallen sharply due to increased logistical costs and customs delays. The value of clothing exports from the UK dropped dramatically in 2021 and continued to decline in 2023. SMEs have faced greater challenges due to Brexit, with many struggling to navigate the new trade barriers and increased costs. Some have had to reduce their exports to the EU or focus on the domestic market. Many smaller designers and independent brands have found the paperwork and costs associated with EU trade prohibitive.

Supply chain disruptions: Uncertainties surrounding border procedures, customs checks, and regulatory compliance have disrupted supply chains, leading to delays, shortages, and increased transportation costs for UK brands sourcing materials or products from EU suppliers.

Labor shortages: Brexit has led to an exodus of EU fashion professionals from the UK workforce, creating labor shortages and limiting collaborative opportunities that once fueled innovation.

Shifting consumer behavior: While the overall market has grown, Brexit has contributed to shifts in consumer behavior, with some consumers expressing concerns about the impact on prices and availability of goods.

Despite the challenges, Brexit has also presented some opportunities for the UK apparel retail industry. The focus more on domestic market now as UK brands can capitalize on the growing domestic market by offering unique and high-quality products. In fact, large retailers like Next have been able to absorb some of the increased costs associated with Brexit and have continued to perform well in the market. Exports are more diversified as businesses can explore new export opportunities in non-EU markets to reduce reliance on the EU. The industry can focus more on innovation and sustainability to attract environmentally conscious consumers. And the continued growth of e-commerce provides opportunities for UK brands to reach customers both domestically and internationally. In fact, online marketplaces like ASOS and Boohoo have emerged as important platforms for UK brands to reach EU customers, mitigating some of the challenges associated with direct exports. However, even online retailers face increased logistical complexities.

Potential impact of a UK-India FTA

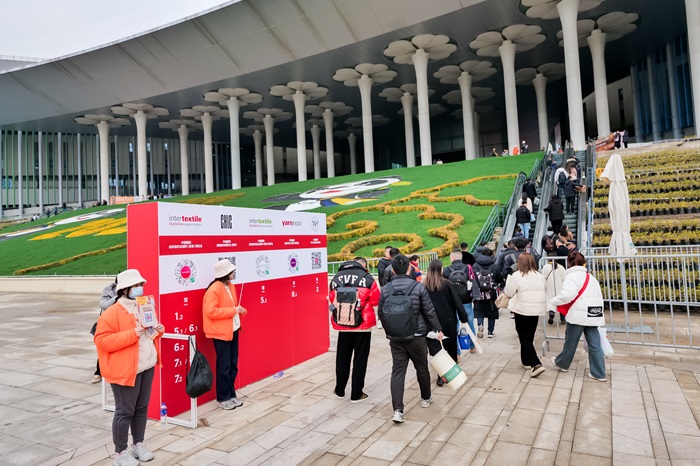

A UK-India FTA could significantly alter the landscape for British apparel retailers in several ways. It could lead to sourcing revolution. India is a global textile and garment manufacturing powerhouse an FTA could drastically reduce or eliminate tariffs on apparel imports from India, offering UK brands access to a vast and potentially more cost-effective sourcing base. This could lead to lower input costs for UK retailers, potentially leading to more competitive pricing for consumers. India offers an alternative to traditional sourcing hubs, reducing reliance on specific regions and mitigating risks associated with geopolitical instability or supply chain disruptions elsewhere. Moreover, India possesses expertise in various textile crafts and manufacturing processes, potentially offering UK brands access to unique and high-quality products.

Lower sourcing costs from India would enable UK retailers to offer more competitive prices, potentially boosting sales and market share. This could also help mitigate the inflationary pressures currently facing the UK market. Access to competitively priced, high-quality apparel sourced from India could make UK brands more attractive to consumers. This could lead to increased sales both domestically and potentially in export markets. While beneficial for UK brands sourcing from India, an FTA could also increase competition within the UK market from Indian apparel brands directly exporting to the UK.

Challenges and considerations

The specific rules of origin within the FTA will be crucial. They will determine how much of the value addition needs to occur in India for goods to qualify for preferential tariff treatment. Moreover UK brands will need to ensure that their sourcing from India adheres to ethical labor practices and environmental standards. Establishing efficient and reliable supply chains between India and the UK will be essential for realizing the full benefits of the FTA. What’s most important is the final terms of the FTA will determine the extent of the benefits for both sides.

Thus a UK-India FTA has the potential to significantly reshape the British apparel retail scenairo. While challenges exist, the opportunities for sourcing diversification, cost reduction, and sales growth are substantial. UK apparel brands need to proactively assess the potential impact of such an agreement and develop strategies to leverage its benefits while mitigating potential risks. The evolving global trade landscape demands agility and adaptability, and a well-negotiated FTA with India could offer a significant competitive advantage to UK apparel retailers.