GST will have little effect on prices of textile products. However, the cut in GST rates on job work done in natural fibers including cotton and woolens has provided a major relief to textile companies. The move is expected to boost domestic business and increase international competitiveness. It will reduce the tax burden and avoid inverted duty for textile manufacturers.

The relief is expected to benefit the unorganised sector, where as much as 80 per cent of the work such as stitching, weaving and knitting happens. The five per cent tax rate is applicable for job works in apparel as well as shawls and carpets. Textile groups want to know whether operations like packaging, shifting of raw materials, loading and unloading also fall in the five per cent slab. Much of such operations are contractual but still have indirect tax implications for a company.

GST has been reduced to five per cent from the initially decided 18 per cent. The lower GST slab is expected to benefit the entire value chain of the textile sector. Though the five per cent tax rate is applicable for job work in apparel as well as shawls and carpets, it’s felt the tax relaxation will benefit the unorganised sector more. Textile companies want clarification over the term job work, which could include manufacturing activities such as weaving, cutting and knitting.

GST won’t affect textile prices

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

CMAI FAB Show 2024 wraps up successfully, boosting textile industry

The Fabrics, Accessories & Beyond Show 2024 (FAB Show 2024), organized by the Clothing Manufacturers Association of India (CMAI), concluded... Read more

US retail sales on the rise, but fashion sector growth murky

American consumers are opening their wallets again, with retail sales experiencing a modest uptick in recent months. According to the... Read more

The Fast Fashion Conundrum: Profits soaring, sustainability stalling

The story of Shein's soaring profits in 2023 presents a fascinating paradox. While a growing number of consumers, particularly millennials... Read more

Wall Street and the Seduction of Sexy Calvin Klein Ads: Hype or performance boos…

The recent Calvin Klein campaign featuring Jeremy Allen White in his skivvies has set the fashion world abuzz. But can... Read more

Looming Iran-Israel conflict threatens to unravel global apparel trade

The already fragile global garment industry faces fresh challenges as tensions escalate between Iran and Israel. This adds another layer... Read more

Fabric Stock Services: A rising trend but not a replacement

The fashion industry is notorious for waste. Unsold garments and excess fabric often end up in landfills. Fabric stock services... Read more

CMAI’s FAB Show 2024 inaugurated with industry giants

The 4th edition of the Fabrics Accessories & Beyond Show 2024 (FAB Show), hosted by the Clothing Manufacturers Association of... Read more

Asian Apparel Exports: A tale of four tigers, one lagging behind

The apparel industry in Asia presents a fascinating picture of contrasting fortunes. While Bangladesh, Vietnam, and Sri Lanka have seen... Read more

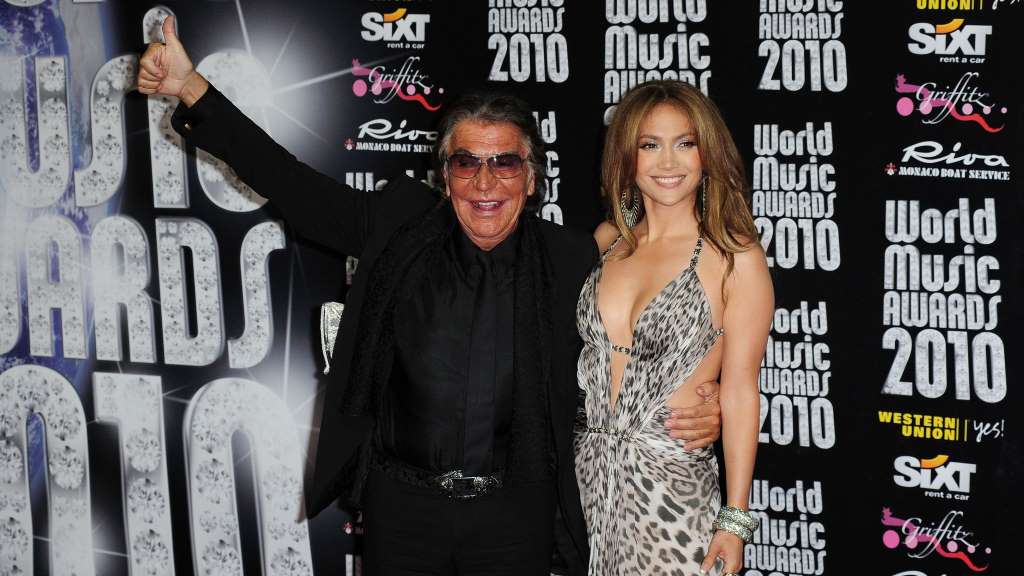

Roberto Cavalli: A legacy of bold prints and unbridled glamour

Roberto Cavalli, the iconic Italian designer who passed away on April 12, 2024, leaves behind a rich legacy. Cavalli was... Read more

Candiani & Madh unveil first regenerative cotton jeans

In a move towards sustainable fashion, Swedish denim brand Madh has partnered with Italian producer Candiani Denim to introduce the... Read more