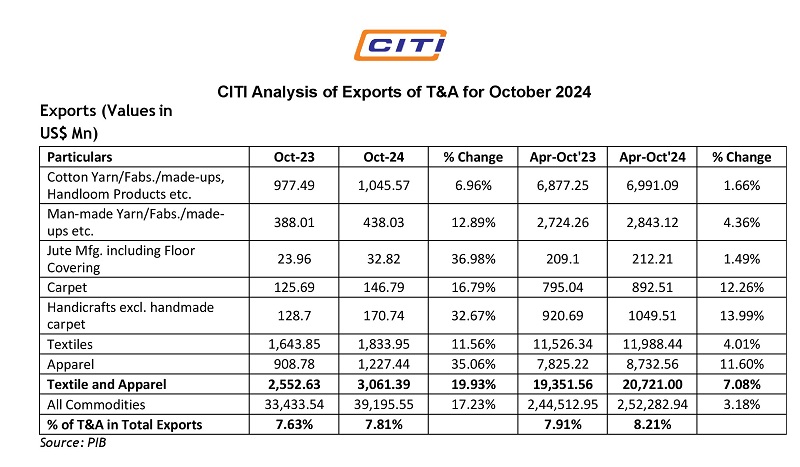

A recent report by the United States International Trade Commission (USITC) highlights a significant shift in global apparel sourcing strategies, with India emerging a preferred destination for US buyers. This trend is driven by growing concerns about the garment sector in Bangladesh, coupled with India's increasing credibility as a reliable and stable sourcing partner.

India's rise

The USITC report highlights India's political stability as a crucial factor for US buyers, ensuring confidence in production and delivery timelines. "Brands are more willing to source high-value or fashion items from India compared to less politically stable countries," the report states. This sentiment is echoed by industry stakeholders in India who anticipate a rise in orders, despite the domestic market currently consuming 80 per cent of production.

Besides political stability what works for India is the vertical integration of the textiles sector. India's cotton garment sector benefits from a strong domestic supply chain, thus increasing its appeal as a reliable supplier. The report also recognizes India's specialization in high-value, skill-intensive apparel, dispelling the notion of it being solely a cost-efficient producer. Labor costs and scalability are another plus for India. High labor costs, smaller production units, and expensive logistics pose challenges to scalability. However, on the down side, the limited capacity for manufacturing man-made fiber (MMF) garments restricts India's growth potential in this segment.

Table: A comparative analysis of countries

Country 2013 US Apparel import share (%) 2023 US Apparel import share (%) Key strengths Key challenges China 37.7 21.3 Cost-efficiency, large-scale production Rising labor costs, trade tensions, geopolitical concerns Vietnam 10 17.8 Competitive labor costs, government support, proximity to China Potential over-reliance on China for raw materials Bangladesh 6.3 11.4 Low labor costs, established garment industry Political instability, labor rights concerns, infrastructure limitations India 4 5.8 Political stability, vertical integration, high-value products Labor costs, scalability challenges, limited MMF capacity

Perspectives from key players

India: Industry players are optimistic about the potential increase in orders. Mithileshwar Thakur, Secretary General of the Apparel Export Promotion Council, says the USITC report "has busted the myth by projecting the Indian apparel industry as one specializing in high value-added products."

Bangladesh: The garment sector in Bangladesh is facing challenges due to political instability and rising costs. This has led to concerns about losing market share to competitors like India.

China: China's dominance in the US apparel market has diminished significantly, with its share dropping from 37.7 per cent in 2013 to 21.3 per cent in 2023. Rising labor costs and trade tensions have contributed to this decline.

Vietnam: Vietnam has emerged as a major beneficiary of the shifting landscape, with its share in US apparel imports increasing from 10 per cent to 17.8 per cent over the past decade. Its competitive labor costs and favorable trade agreements have given a growth boost.

The USITC report underscores a dynamic shift in global apparel sourcing, with India gaining prominence as a reliable and high-quality supplier. While challenges remain, India's strengths in vertical integration, political stability, and high-value production position it to capitalize on this evolving landscape. However, addressing labor costs, scalability issues, and expanding MMF capacity will be crucial for India to solidify its position as a leading apparel sourcing hub.