The landscape of apparel exports to Europe is undergoing a significant transformation, driven by changing consumer demands, sustainability concerns, and geopolitical shifts. The European Union (EU) represents a vast and lucrative apparel market, one that is undergoing a significant shift in its import dynamics. While traditional giants like China continue to hold sway, a new wave of players is rising, driven by factors ranging from economic diversification to ethical concerns.

Top exporting countries

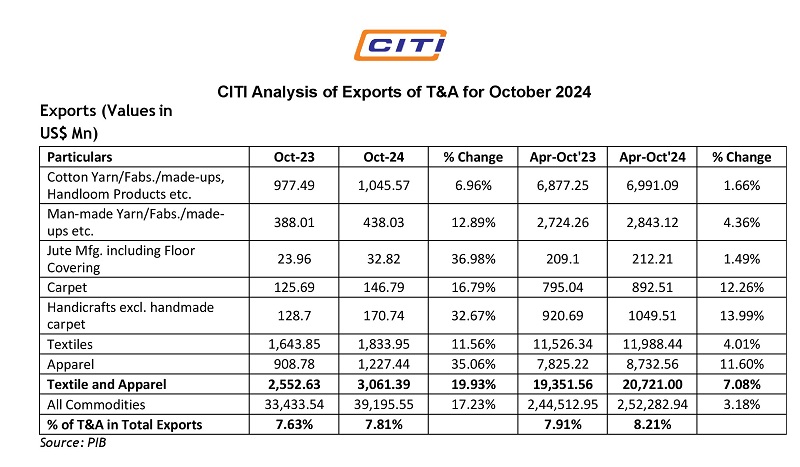

As per CBI while China remains the dominant player, its share has been declining (15 per cent in 2022, down from 17 per cent in 2017). Emerging as a strong contender, Bangladesh's share increased from 9.5 per cent in 2017 to 11.5 per cent in 2022, driven by competitive pricing and proactive sustainability efforts. Turkey a geographically close supplier, benefits from preferential trade agreements and holds a 6 per cent share, but faces challenges in production diversification.

India (2.4 per cent), Vietnam, Cambodia are gaining ground, driven by competitive pricing, diversification, and improved compliance standards.

Table: Top Exporters: A changing landscape

| Rank | Country | 2022 Export Value (€) | 2022 Share (%) | 2019 Export Value (€) | 2019 Share (%) | Change (2019-22) |

| 1 | China | 28.7 bn | 15.0 % | 32.4 bn | 16.9 % | -11.4 % |

| 2 | Bangladesh | 21.9 bn | 11.5 % | 17.6 bn | 9.2 % | 24.4 % |

| 3 | Turkey | 11.4 bn | 6.0 % | 10.8 bn | 5.6 % | 5.6 % |

| 4 | India | 4.6 bn | 2.4 % | 4.2 bn | 2.2 % | 9.5 % |

| 5 | Vietnam | 4.4 bn | 2.3 % | 3.3 bn | 1.7 % | 33.3 % |

Data Source: CBI, Eurostat

Changing product categories

As per McKinsey menswear is dominated by casualwear and sportswear, with growing demand for athleisure and premium casuals. Shirts, knitwear, and trousers dominate. In women's wear dresses, tops, and T-shirts are leading categories, followed by activewear and denim. In kid’s wear casualwear and activewear are top sellers, with growing interest in sustainable and ethically produced options. Sustainability is playing an increasingly important role, with demand for organic cotton, recycled materials, and fair labor practices rising. “Consumers are increasingly seeking transparency, sustainability, and ethical production in their clothing choices," says Achim Berg, Managing Director, The European Apparel and Textile Industry Confederation.

Among segments, knitwear sweaters, jumpers, and cardigans remain popular, with a growing focus on natural fibers and comfort. In denimwear jeans and jackets continue to be mainstays, but sustainable and innovative denim is gaining traction. Coats, jackets, and parkas see strong demand, with puffer jackets and technical outerwear gaining popularity in outerwear. As for activewear, lingerie, and swimwear are important segments, driven by rising consumer interest in health and wellness.

Asia leads value segment

Value segment driven by price competitiveness, is dominated by Asian manufacturers like Bangladesh and China. The premium segment has European brands and manufacturers in strong position, focusing on quality, design, and sustainability. For example Portugal’s focus on high-quality, sustainable knitwear and technical textiles has attracted premium brands and boosted its export value. Fashion heritage and innovative designs continue to position Italy as a leader in the premium segment, despite production challenges. Emerging markets like India and Turkey are increasingly targeting mid-range segments, offering good value and quality.

Paradigm shift

"The future of apparel exports to Europe lies in innovation, diversification, and catering to evolving consumer preferences," says Veronica Grimm, Director-General, Directorate-General for Trade, European Commission. The shift is happening on these lines.

Sustainability: A growing focus on ethical production, eco-friendly materials, and circularity is reshaping the industry.

Nearshoring: Rising production costs and geopolitical tensions are mendorong a shift towards sourcing from geographically closer countries.

Technology: Automation, digitalization, and data analytics are transforming supply chains and enhancing efficiency.

Consumer preferences: Shifting towards quality, sustainability, and personalization are driving product development and marketing strategies.

Future outlook

Experts say, sustainability will be a key differentiator, with stricter regulations and consumer demands impacting sourcing and production practices. Regional sourcing, digitalization, and automation will be crucial for competitiveness in a volatile global environment. Premium and niche segments will offer potential for growth, while value/commodity segments will require innovation and cost optimization. Personalization and omnichannel experiences will become increasingly important to engage consumers.

Note: Data collated from various sources