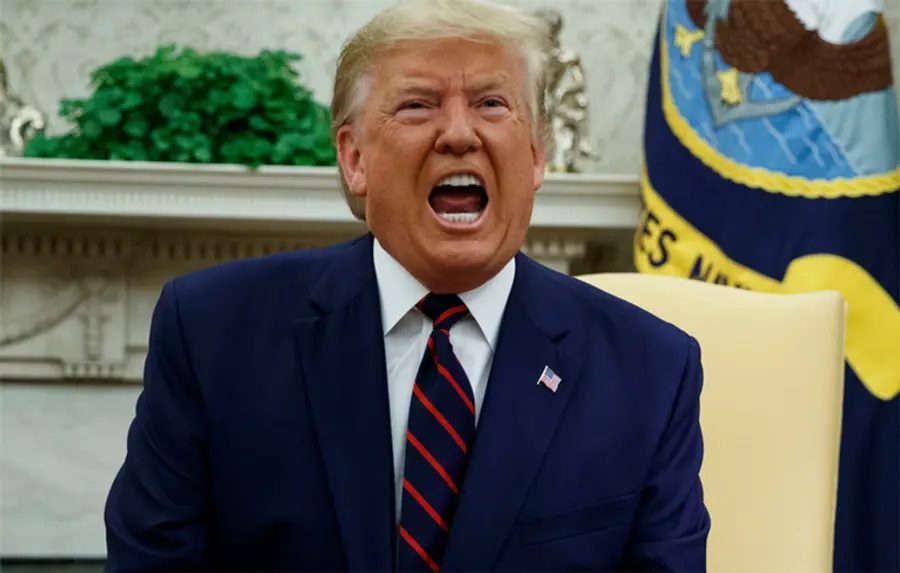

The fashion, apparel, and textiles sector is facing a potential upheaval as the US government announces a new 10 percent tariff on goods imported from China. Trump has called out 25 per cent tariffs for Mexico and Canada and 10 per cent for China, the US’ three largest trade partners, for which the US imported more than $1.2 trillion worth of goods in 2023. This move comes on the heels of a study released by the National Retail Federation (NRF), which highlights the economic consequences of such tariffs. The NRF study, conducted by Trade Partnership Worldwide, titled ‘Estimated Impacts of Proposed Tariffs on Imports’ analyzed the potential impact of tariffs on a wide range of consumer goods, including the fashion industry.

The study concluded tariffs would lead to:

Higher costs of doing business: Importers and retailers will face higher costs for goods sourced from China, potentially leading to reduced profit margins or increased prices for consumers.

Job losses: The study estimates significant job losses across various sectors, including retail and manufacturing, as businesses grapple with increased costs and reduced consumer spending.

Supply chain disruptions: Tariffs could disrupt established supply chains, forcing businesses to seek alternative sourcing options, potentially leading to delays and increased complexity.

The additional 10 per cent tariff on Chinese imports affects the fashion industry that is particularly vulnerable. China is a major supplier of raw materials, fabrics, and finished garments for many global brands. According to the USITC, China accounted for approximately 30 per cent of US apparel imports in 2023. This reliance on Chinese imports highlights the potential impact of the new tariffs on the US fashion industry. The NRF study estimates that a 10 per cent tariff on Chinese imports could lead to a loss of over 200,000 US jobs and reduce GDP by $30 billion.

The new tariff could significantly impact the industry in several ways. For example, increased import costs are likely to be passed on to consumers in the form of higher prices for clothing and accessories. This could reduce consumer demand and impact sales. Fashion companies may be forced to diversify their sourcing, moving away from China to avoid the tariffs. This could lead to increased production costs and logistical challenges as companies establish new supplier relationships in countries like Vietnam, Bangladesh, or India. While some argue tariffs could boost domestic manufacturing, the reality is more complex. The US fashion industry has gone through significant offshoring in recent decades, and rebuilding domestic production capacity would require substantial investment and time.

Indeed, the new tariffs on Chinese imports are a challenge for the US fashion, apparel, and textile sector. Businesses will need to adapt quickly, exploring alternative sourcing strategies, optimizing their supply chains, and potentially adjusting their pricing strategies to remain competitive in this evolving landscape. The long-term impact of these tariffs on the industry and the global economy remains to be seen.