The clang of tariffs reverberates through the global textile and apparel industry, as the United States' strategy of reciprocal levies forces a dramatic restructuring of trade flows. The policy, designed to level the playing field, has ignited a fierce competition among major exporters China, Vietnam, India, and Bangladesh each vying for a larger slice of the lucrative US market. However, it's India that's emerging as a particularly keen contender, sensing a unique opportunity to capitalize on China's tariff-induced challenges and leverage a potential US trade deal to its advantage.

The Tariff Divide: A foundation for disruption

At the core of this trade upheaval lies the "tariff differential," a strategic tool employed by the US to address perceived trade imbalances. This differential the disparity between tariffs imposed by the US and those imposed by its trading partners creates a complex landscape where some nations face steeper levies than others. Data from Nomura reveals the stark contrasts:

|

Country |

Average Tariff Difference |

|

India |

15.60% |

|

Vietnam |

-12.30% |

|

Bangladesh |

9.37% |

This disparity directly impacts the cost competitiveness of these nations' exports. India and Bangladesh, with their positive differentials, face the prospect of higher costs in the US market, while Vietnam, with its negative differential, stands on comparatively firmer ground.

Export Dynamics: A data-driven shift

The impact of these tariffs is evident in the shifting export volumes. Data from the Office of Textiles and Apparel (OTEXA) confirms a decline in Chinese textile exports to the US, while Vietnam experiences a notable surge. This realignment is further illuminated by detailed tariff data:

|

Country |

Avg. Tariff on US Imports |

Avg. Tariff on Exports to US |

Source |

|

India |

24.80% |

9.20% |

Nomura |

|

Vietnam |

0.70% |

13% |

Nomura |

|

Bangladesh |

25% |

15.62% |

Nomura/World Bank |

The price sensitivity of the textile market amplifies these effects. Reports from market analysis firms indicate that manufacturers are grappling with increased costs, forcing them to absorb losses or seek alternative markets. India's Apparel Export Promotion Council (AEPC) highlights that 28 per cent of India's textile and apparel exports go to the US, with significant tariff variations lower duties on cotton fabrics and as high as 33 per cent on man-made fibers.

India's Two-Pronged Strategic Play: US trade deal and market share gains

With China facing considerable tariff pressure, and the US indicating a desire to enact reciprocal tariffs upon India, India sees not only an opportunity to expand its footprint in the US market, but a necessity to protect its economic interests. A planned bilateral trade agreement with the US could be used to push for increased textile exports, alongside other industries like agriculture, aluminium, and steel, to mitigate the potential damage from reciprocal tariffs.

This trade agreement is seen as a vital shield, ensuring that Indian exports remain competitive. The Global Trade Research Initiative (GTRI) has identified that while textiles face significant tariff differences, agricultural exports could be the most severely affected, thus highlighting the urgency of a comprehensive trade deal.

Vietnam and Bangladesh: Navigating the tariff maze

While India strategically pursues a trade deal, Vietnam and Bangladesh face their own set of challenges. Vietnam has surged to become the largest textile exporter to the US in the first five months of 2024, surpassing China. However, 70 per cent of both Vietnam's and Bangladesh's textile and apparel exports consist of ready-made garments, which face the prospect of higher tariffs.

Bangladesh, heavily reliant on its textile sector (11 per cent of its economy), and Vietnam, where textiles account for 15 per cent of the economy, are particularly vulnerable to tariff fluctuations. In contrast, India's diversified economy, with textiles contributing 2.3 per cent to its GDP, provides a buffer.

The Evolving Landscape: Adapting to change

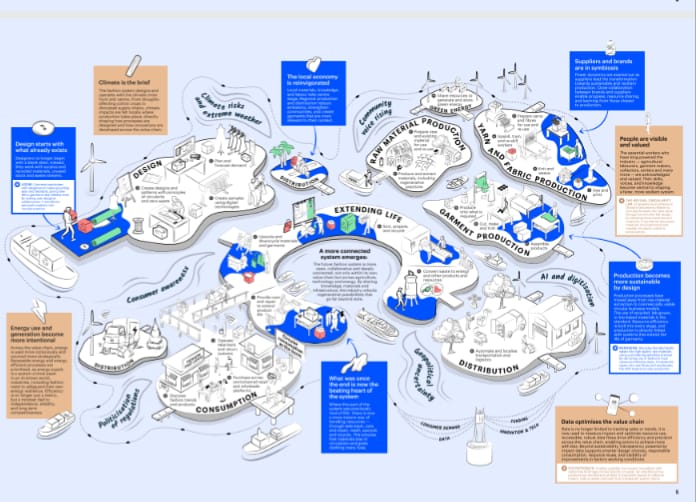

The long-term implications of the US reciprocal tariffs remain uncertain. However, the global textile industry is undergoing a profound transformation. Manufacturers are diversifying their supply chains, investing in

|

Country |

2013 Textile Exports (USD Billion) |

2023 Textile Exports (USD Billion) |

Source |

|

India |

34.2 |

36.36 |

WITS, DGCI&S, GTRI estimates |

|

Vietnam |

23 |

45.2 |

WITS, DGCI&S, GTRI estimates |

|

Bangladesh |

27.74 |

46.4 |

WITS, DGCI&S, GTRI estimates |

The ability to adapt to these changes will determine the success of each nation. Future trends will be shaped by US trade policy, including the results of any potential trade agreements, technological advancements, and the growth of alternative markets. India, with its strategic vision and growing manufacturing capabilities, coupled with the pursuit of a vital trade deal, is poised to play a pivotal role in this evolving landscape.