"The garment industry - a labour intensive, low-skill manufacturing process - has been one of the catalysts for the economic growth in the Asian countries for several decades. There is however a twist. The garment manufacturing sector is gradually slowing down among the Asia tigers -promising opportunities for other markets such as Kenya where aspects of production cost such as labour inflation remain slightly lower. "

Garment manufacturing sector is gradually slowing down among the Asia tigers, promising opportunities for other markets such as Kenya where aspects of production cost such as labour inflation remain slightly lower.

The garment industry - a labour intensive, low-skill manufacturing process - has been one of the catalysts for the economic growth in the Asian countries for several decades. There is however a twist. The garment manufacturing sector is gradually slowing down among the Asia tigers -promising opportunities for other markets such as Kenya where aspects of production cost such as labour inflation remain slightly lower.

According to analysts, China will shed about 85 million jobs at the bottom end of the manufacturing sector between now and 2030. Today, as production costs rise in Asia, Sub-Saharan Africa offers the last frontier in the search for new apparel sourcing markets. With a strong apparel tradition, a large and entrepreneurial workforce, and an attractive business environment, Kenya is a compelling new sourcing, a new study report on the Kenyan textile and fashion industry says.

Advantage Kenya

This opportunity coupled with the apparel exports under the African Growth and Opportunity Act (AGOA) - a United States preferential market access deal for qualifying sub-Saharan countries, improved infrastructure and cheaper power bodes well for Kenya garments sector. Fortunately for Kenya, its textile industry is just picking up after decades of a slump due to mismanagement and stiff competition from cheaper imports and second-hand clothes.

Data from the Kenya National Bureau of Statistics (KNBS) showed that Export Processing Zones (EPZ) recorded a 12.1 per cent growth in sales in 2015, underlining a resurgence of the sub-sector that is expected to be a key pillar of Kenya’s development. The growth was mostly driven by apparel exports under AGOA.

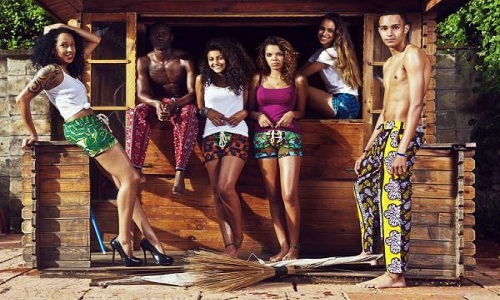

The opportunities in Asia give Kenya a chance to grow its textile export volumes and designs in the global scene. Kenya also has a deep well-spring of talent among fashion designers and small tailors, who can serve both the global, domestic, and regional markets, says the study report by international development firm, Hivos Limited and Equity Bank.

Recently, fashion enthusiasts converged in a Nairobi hotel to review the status of the Kenya textile industry and brainstorm on how they would work to tap on the unfolding opportunities not just internationally but also locally. There is however plenty of work lying ahead if Kenya is fully to exploit opportunities both domestically and abroad.

The real issues

Despite hosting numerous shows, boasting an avalanche of bloggers and the rich talent exhibited by local fashion designers, the study by Hivos and Equity Bank revealed that the textile industry in Kenya is quite fragmented, which has prevented it from blooming.

As per the report, most of the local players operate in isolation with no linkages to the retail platform. Data shows that there are about 75,000 micro and small companies, including fashion designers and tailoring units. An estimated 80 per cent of them operate in the informal sector and use rudimentary equipment.

More than three quarters are owned by women while 91 per cent sell solely to the local market while most of the upcoming designers have a growing desire to be famous first rather than being rich first, the study further said.

This potential remains largely untapped due to systemic and structural weaknesses of the T&C (Textile and Clothing) industry, which, despite its rich history of over 100 years, remains fragmented, unco-ordinated and misaligned. The sector is skewed towards cottage industries and low value-addition garment making, with an attendant steady decline in the textile sector, the study further says.

Government’s strategy

Meanwhile, the Kenyan government’s medium-term economic growth strategy, Kenya Vision 2030, has identified the textile and clothing sector as a potential key driver of the country’s industrialisation.

The sector currently comprises 22 large foreign owned companies operating in the Export Processing Zones (EPZs), 170 medium and large companies, eight ginneries, eight spinners, 15 weaving and knitting companies, nine accessories manufacturers and over 75,000 micro and small companies, including fashion designers and tailoring units.

It spans the Fiber to Fashion (F2F) value-chain (cotton cultivation, ginning, spinning, weaving, knitting, dyeing and finishing, garment and accessories manufacturing). The Industrialisation ministry is seeking to adopt a new model of Special Economic Zones (SEZs) to replace the EPZs whose performance has been termed disappointing.

Kenya is currently setting up several SEZs in Mombasa, Lamu and Kisumu. The Kisumu facility is aimed at growing export trade within the East Africa Community (EAC) and the Great Lakes region.

SEZs shall be subject to a reduced corporation tax of 10 per cent for the first 10 years and 15 per cent for the next 10 years. Unlike EPZs which are limited to manufacturing, commercial and service activities, the SEZ Act provides a long non-exhaustive list of activities.

They include business processing outsourcing, manufacturing and processing; livestock marshalling and inspection, refrigeration, deboning, value addition; and services and activities to facilitate tourism and recreation sector.

However, the World Bank says that the success of the SEZs will depend on provision of proper infrastructure - both within the zone and connecting it to the outside world. Among the factors that have previously held back the success of the EPZs was a poor transport infrastructure and high electricity costs.