"With bold labour reforms, implementation of GST, robust export infrastructure coupled with innovation & technology, Indian textile and apparel industry has the potential to fundamentally change its trajectory, create over 50 million jobs, bring social transformation and gain global dominance. At the same time, moving an entire industry and creating millions of jobs seems a herculean task. These are some of the observations of a study on the ‘Indian Apparel, Made-ups & Textile Industry’ commissioned by the Confederation of Indian Industry (CII) to identify the key catalysts that will enable breakout growth."

With bold labour reforms, implementation of GST, robust export infrastructure coupled with innovation & technology, Indian textile and apparel industry has the potential to fundamentally change its trajectory, create over 50 million jobs, bring social transformation and gain global dominance. At the same time, moving an entire industry and creating millions of jobs seems a herculean task. These are some of the observations of a study on the ‘Indian Apparel, Made-ups & Textile Industry’ commissioned by the Confederation of Indian Industry (CII) to identify the key catalysts that will enable breakout growth.

The study says, the industry today is ominous and opportune. With an increase in wages and the Yuan gaining strength, industry is shifting its base away from China, creating a potential market of $280+ billion for other countries to capture. The shift is already happening in the apparel sector, large shifts are expected in fabric and yarn sourcing as well. Though Bangladesh and Vietnam are the current frontrunners, emergence of hubs in Africa (e.g. Ethiopia) and a strong resurgence seen for manufacturing in the US, the future landscape could be dramatically different.

Huge employment opportunity

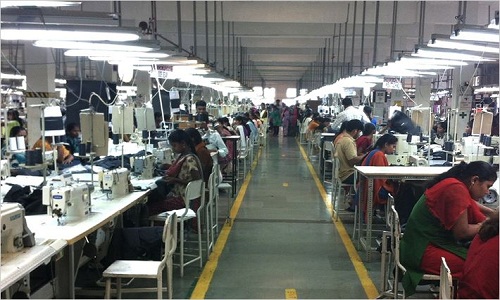

Tapping this opportunity can bring immense social and economic benefits. The sector is the largest industrial employer of women in the country and can provide quick employability to a large mass of workers. If the industry achieves breakout growth, the study estimates another 50 million jobs to be created by 2025 - 35-40 million of which will be employing women. Potential economic benefits are sizeable as well. The study further estimates that the industry can triple in size over the next 10 years, get $150 billion annually in foreign exchange, and spur the apparel, made-ups and textile industry to reach $300 billion by 2025. The domestic market will also grow at least 2.5 times to become around $150 billion in size.

Chandrajit Banerjee, Director General, CII believes, India is uniquely positioned to capitalise on this opportunity. India is the only country in the world other than China to have the entire value chain from fiber to fashion, both in cotton and synthetics, an abundant and young labour force, a vibrant domestic market and a good starting point in exports (2nd largest exporter of textiles, apparel and made-ups in the world).

The study underlines the shifts in global apparel, made-ups and textile industry are going to be shaped by four major factors a) cost competitiveness, especially in labour/wage structures and energy structures per unit of output b) Ease of market access (both in terms of tariffs/duties and time to market) c) Ease of doing business and d) Technical innovations.

CII’s 6-point agenda

Game-changers for the Indian apparel, made-ups and textiles industry as per the CII 6-point agenda are the following:

• Build scale, as the industry is currently highly fragmented and lacks scale. Being highly labour intensive, introduce flexible labour laws; job linked support schemes, innovative hub and spoke models for apparel / textile parks to employ labour in hinterlands and introduce PPP models for Industry to provide scale and create jobs.

• Bridge the operating cost gap, especially on synthetics. Entrepreneurs need to aggressively drive up productivity by investing in world class facilities, process improvements and build a culture of manufacturing excellence. Simplified tax structures and neutral implementation of GST for both cotton and synthetic products will give the much required boost to the industry.

• Infrastructure, especially at ports, import facilities and clearance procedures should be streamlined to cut turnaround times. Signing FTAs with major markets like the European Union can equalise market access positions with key competitors like Bangladesh.

• Increase investments in technology, especially processing and technical textiles either through capital subsidy or technology partnerships. The A-TUFS released in December 2015 has taken welcome steps in this respect.

• To actualise ‘Make-in-India’ movement, government can create a comprehensive umbrella of support schemes under the 'Make-in-India' banner. Entrepreneurs need to advertise the made-in-India aspect aggressively, over-invest in quality and make their products worthy of putting up 'Proudly Indian' labels.

• Finally, Indian entrepreneurs need to invest both financial and human resources on technology and innovation to address the constantly evolving markets. Investments are required in technical textiles, processing, and apparel making in particular. India needs to create its own 'silicon-valleys' for technical textiles, with a full ecosystem of investors, start-ups, production facilities and ultra-fast clearances. Ease of doing business is equally critical for innovation.