"Clariant and Huntsman Corporation have merged together to form a company called Huntsman Clariant. On a pro forma 2016 basis, the combination of both companies will create a leading global specialty chemical company with sales of approximately 13.2 billion dollars, an adjusted EBITDA of 2.3 billion dollars and a combined enterprise value of approximately 20 billion dollars."

Clariant and Huntsman Corporation have merged together to form a company called Huntsman Clariant. On a pro forma 2016 basis, the combination of both companies will create a leading global specialty chemical company with sales of approximately 13.2 billion dollars, an adjusted EBITDA of 2.3 billion dollars and a combined enterprise value of approximately 20 billion dollars.

The combined entity will benefit from each other’s strengths. It will have a significantly improved growth profile in highly attractive end markets and geographies. Huntsman Clariant will leverage shared knowledge in sustainability and boast a much stronger joint innovation platform. This will enable the development of new products in order to deliver superior returns and drive shareholder value.

Clariant and Huntsman are joining forces to gain a much broader global reach, create more sustained innovation power and achieve new growth opportunities.

The combined company is incorporated in Switzerland and will be governed by a board of directors with equal representation from Clariant and Huntsman .The new company will accelerate value creation for shareholders through a more robust combination of technology, products and talent. The combined company expects to realize more than 3.5 billion dollars of value creation from approximately 400 million dollars in annual cost synergies.

The full synergy run-rate will be achieved within two years of closing. These synergies will be realized by reducing operational costs and improving procurement. The targeted synergies represent roughly three per cent of the total combined 2016 revenue. There will also be additional cash-tax savings.

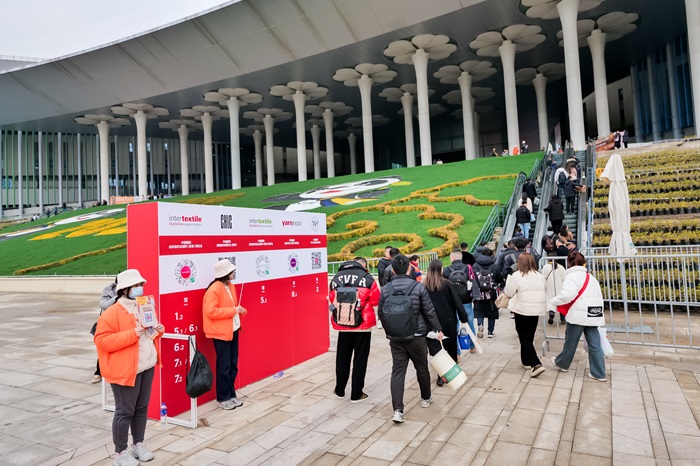

The expectation is of enhanced returns from the improved growth profile in highly attractive end markets and key geographies such as the United States and China. The merger presents opportunities for stronger joint innovation platforms and shared knowledge in sustainability. What the merged entity looks forward to is a stronger balance sheet and cash flow generation. The plan is to continue Clariant’s attractive dividend policy.

The transaction is targeted to close by year end 2017.