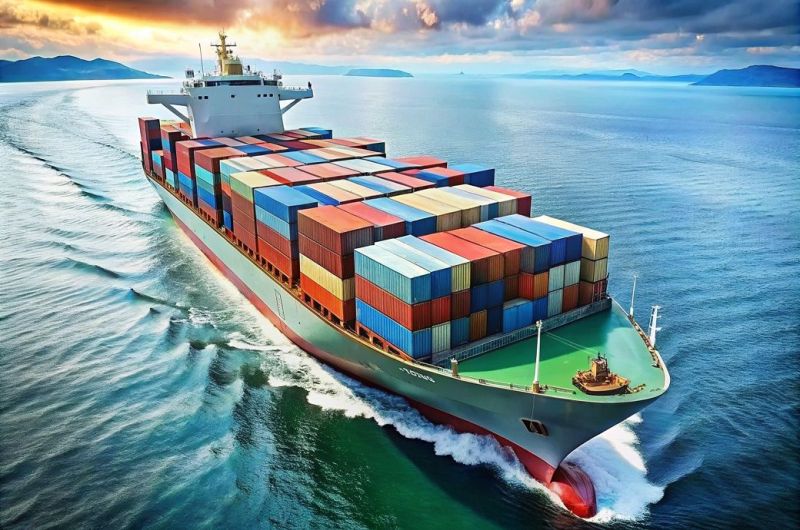

"While the rupee having depreciated substantially in the past year to trade at about 66.60 to 66.80 against the dollar compared to around 62 a year ago, other emerging markets currencies including the Chinese yuan have weakened much more sharply, which makes it even cheaper for foreign countries to buy products from countries such as China."

India has set a target of $900 billion in exports by 2020, from the $470 million reported in the last financial year. However, according to a report by Crisil Research, “This might prove a tad too ambitious if the current cyclical slowdown lasts and structural issues are not addressed”.

Slow global economy and dwindling competitiveness

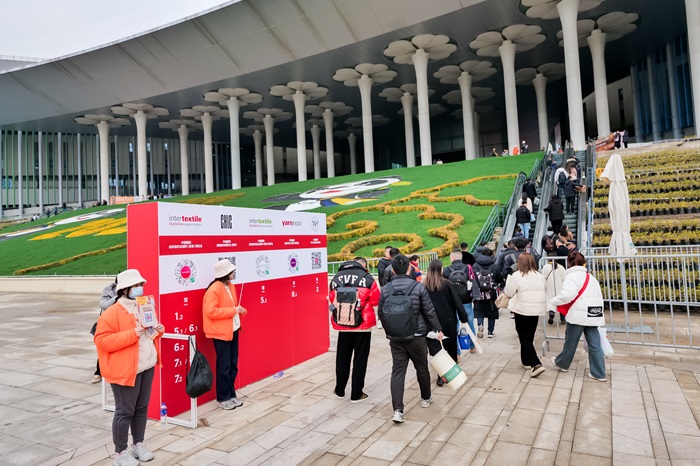

India’s merchandise exports fell by 18.5 per cent in dollar terms to $174.3billion in the first eight months of this fiscal year, between March 2015 to April 2016. “Falling competitiveness is one of the structural factors restricting export growth,” the report points out, adding, “For key export items such as gems and jewellery, and textiles, revealed comparative advantage has come down over the years. Non-tariff barriers such as high transaction costs and infrastructure deficit, too, create hindrance as India continues to lag most Asian peers on these parameters.”

“Small wonder India’s export performance has suffered. Export destinations are not doing well, prices of many export items have fallen, and the rupee, too, has appreciated in real terms against a basket of 36 currencies. But our analysis shows the decline in exports is more than that warranted by these factors,” says CRISIL report.

It further points out that while global real GDP growth picked up from 3.2 per cent in 2009-11 to 3.4 per cent in 2012-14, India’s real growth of exports plummeted from 11.1 per cent to 4.1 per cent. “Almost half of all India’s exports are sent to other countries in Asia and the next biggest market for its goods is Europe. Economic weakness in these areas is taking its toll. Country-wise, the biggest contributors to the slowdown in India’s exports have been China, Saudi Arabia, Singapore and Japan, all of which have seen exports contract by double digits in fiscal 2015 and so far in this fiscal,” says Crisil, adding. “These are followed by European markets – the UK, Netherlands, Belgium, Italy and France – all showing continuous decline.”

No sign of revival in sight

Experts feel with official data showing the contribution of exports in India’s GDP falling from 25.2 per cent in the 2013-14 financial year to 21.2 per cent in the first half of the current financial year, there is no hope of a rebound in exports in the near future. While the rupee having depreciated substantially in the past year to trade at about 66.60 to 66.80 against the dollar compared to around 62 a year ago, other emerging markets currencies including the Chinese yuan have weakened much more sharply, which makes it even cheaper for foreign countries to buy products from countries such as China.

Along with reforms in logistics and other sectors and government support in the form of able export policy, India’s exports sector will also have to deal with the threat of being negatively impacted by the Trans Pacific Partnership, a trade agreement which was reached in October 2015 by 12 countries, including the United States, Vietnam, Japan, Mexico, Peru and Australia. “Trans Pacific Partnership countries account for 25 per cent of India’s exports. So by not being a part of TPP, India risks losing out a significant chunk of its export market to rivals,” Crisil warns.

“Clearly, India needs to invest quickly in skilling its large manpower and developing infrastructure to be able to attract foreign investment and become a world-class exporting hub,” the report sums up

www.crisil.com